The rapid growth of the South Korean art auction market has prompted Korea’s two largest auction houses, Seoul Auction and K Auction, to expand their businesses. K Auction is to be listed on KOSDAQ, a trading venue of the Korea Exchange, and Seoul Auction received a large investment from Shinsegae Department Store for joint projects.

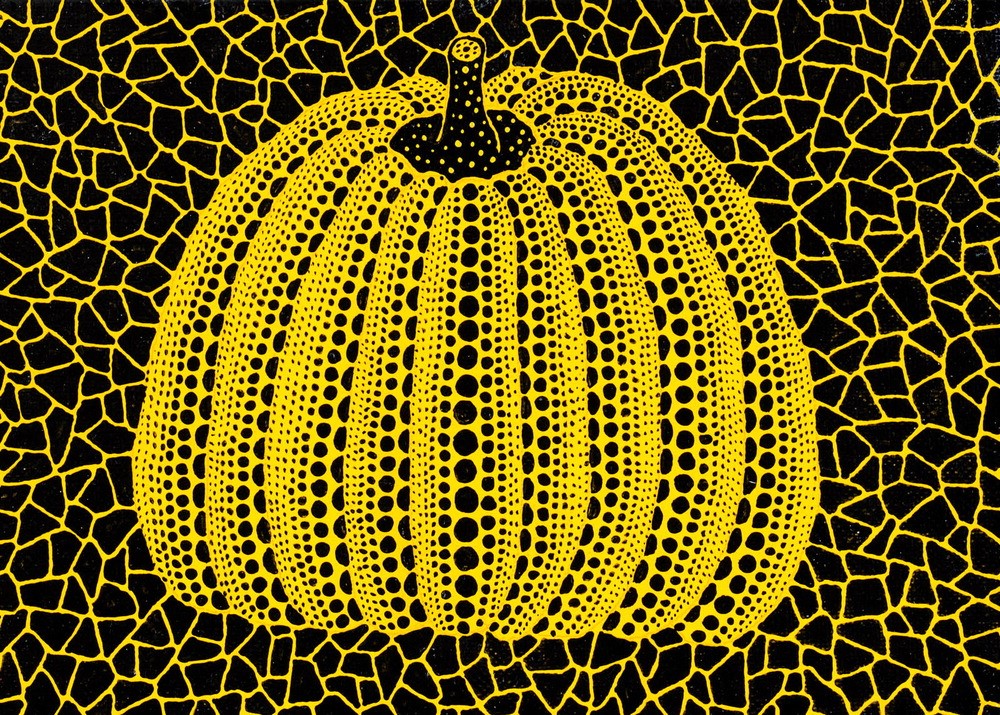

© K Auction.

Founded in 2005, K Auction plans to list on KOSDAQ on January 24, when it will become the second auction house in South Korea to trade on the exchange. The company conducted a two-day public offering beginning on January 12, in which 1,745 institutions participated, representing a competitive ratio of 1,638.36:1. The company’s total IPO price is 32 billion KRW (approximately $2.7 million), while its post-listing market cap is 178.2 billion KRW ($149 million), based upon the IPO price.

In addition to anticipating the growing Korean art market, investors are attracted to Koffice, a database platform for art auctions developed in 2015. Koffice offers various online art auction services and collector management services through an inventory system with more than 110,000 artworks.

With the fund, K Auction will invest in expanding its facilities and acquiring artworks by local and international artists with high investment value. The company is also planning to upgrade its systems, such as the development of an information protection management system (ISMS), which will be used for the first time in the local industry.

K Auction IPO IR. Courtesy of KOSDAQ.

Seoul Auction was founded in 1998 as the first art auction house in South Korea and has been listed on KOSDAQ since 2008. The company received a 28 billion KRW ($23.5 million) investment from Shinsegae Department Store on December 29, 2021.

Shinsegae, one of Korea’s big four department stores together with Lotte, Hyundai, and Galleria, has targeted art as an important marketing tool and last year set a goal to strengthen its art business through exhibitions, sales, rentals, and consulting services. A spokesman for Shinsegae said it decided to invest in Seoul Auction “… to stably source artworks and offer new art-related businesses to our customers.”

Shinsegae also plans to expand its business in non-fungible token (NFT) art auctions in addition to its traditional art business with Seoul Auction.

In November 2021, Seoul Auction partnered with Dunamu, the operator of Korea’s largest cryptocurrency exchange, Upbit, to launch XXBLUE, an NFT art auction platform for rare artworks and limited-edition luxury goods that accepts cryptocurrencies or KRW.

Shinsegae Gallery, Shinsegae Daejeon. Courtesy of Shinsegae.

Seoul Auction and K Auction are the two leading auction houses that dominate more than 90 percent of the South Korean art auction market. The local auction market recorded sales of 329.4 billion KRW (approximately $272 million) in 2021, of which Seoul Auction accounted for 166.6 billion KRW ($139 million) and K Auction for 136 billion KRW ($114 million).

References

- The Korea Herald, K Auction raises more than 5 trillion won at public offering before Kosdaq listing, 2022.01.13

- 머니S, 케이옥션, IPO 흥행 열기 이어갈까… 오늘 공모주 청약 시작, 2022.01.12

- 아주경제, 9000억원 넘어선 국내 미술 시장, 변화의 기로에 서다, 2022.01.05

- 조선비즈, 미술품에 꽂힌 신세계 정유경…서울옥션에 280억 지분 투자, 2021.12.29

- 서울경제, 신세계, 미술품 NFT 사업 진출, 2021.12.29