In 2024, a massive financial scandal rocked the South Korean art market. An art trading company called GALLERY K attracted large sums of money by promising investors a 7-9% annualized return and guaranteed principal, but recently, a class-action lawsuit by customers has revealed the full story.

The

front of GALLERY K's headquarters after the incident

The

front of GALLERY K's headquarters after the incidentThis is not just a financial scam, but a serious case that reveals structural problems in the Korean art market.

(From

left to right) GALLERY K Chairman Kim Jung pil and MISS KOREA JIN Lee Seung

hyun at the Gallery K New Year's Event Ambassador Appointment Ceremony / Photo :

GALLERY K

(From

left to right) GALLERY K Chairman Kim Jung pil and MISS KOREA JIN Lee Seung

hyun at the Gallery K New Year's Event Ambassador Appointment Ceremony / Photo :

GALLERY KGALLERY K uses artwork as a

revenue model

GALLERY K expanded its

business by presenting a model that utilizes art as a tool for generating

revenue rather than as an object to be collected and appreciated. The structure

of renting art to hospitals and companies to generate stable revenue and

distributing it to investors was attractive to investors. The promise to buy

back the artwork after a certain period of time at the original price and

guarantee the principal amount was also an important factor in attracting

investors.

GALLERY K Ad Scene

The company used an aggressive marketing strategy to attract customers, including using famous actor Ha Jung woo and singer Lee Hyun woo to endorse its products. As a result, the company's revenue exploded from KRW 13 billion in 2020 to KRW 66.2 billion in 2023. However, in early 2024, the company began to experience problems with delays in paying promised returns to investors and returning their principal. The company failed to fulfill its promises to resell and repurchase artworks after the contracts were terminated, and to date, more than 200 people have been victimized, with damages estimated to reach 100 billion won.

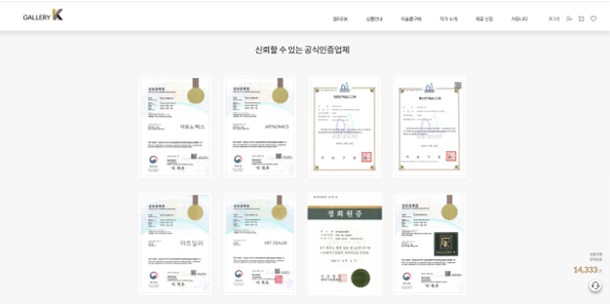

Gallery

K Homepage Capture picture / The company emphasizes that it is a trustworthy

company with various certificates of registration.

Gallery

K Homepage Capture picture / The company emphasizes that it is a trustworthy

company with various certificates of registration.Kim Jung pil, the chairman of GALLERY K, has fled the country shortly before he was indicted on charges of a 100-billion-won fraud. According to a YTN report, Kim was a vice president of FMI Global, a company that was accused of running a tens of billions of won fraud six years ago.

Storing artwork in a warehouse without actually renting it out / YTN Youtube Captured picture

At the time, it was confirmed that one of FMI Global's products, which attracted money by claiming to invest in various assets such as foreign exchange, was an 'Art-Income' similar to GALLERY K Artnomics, and it operated a fund with a similar business method six years ago.

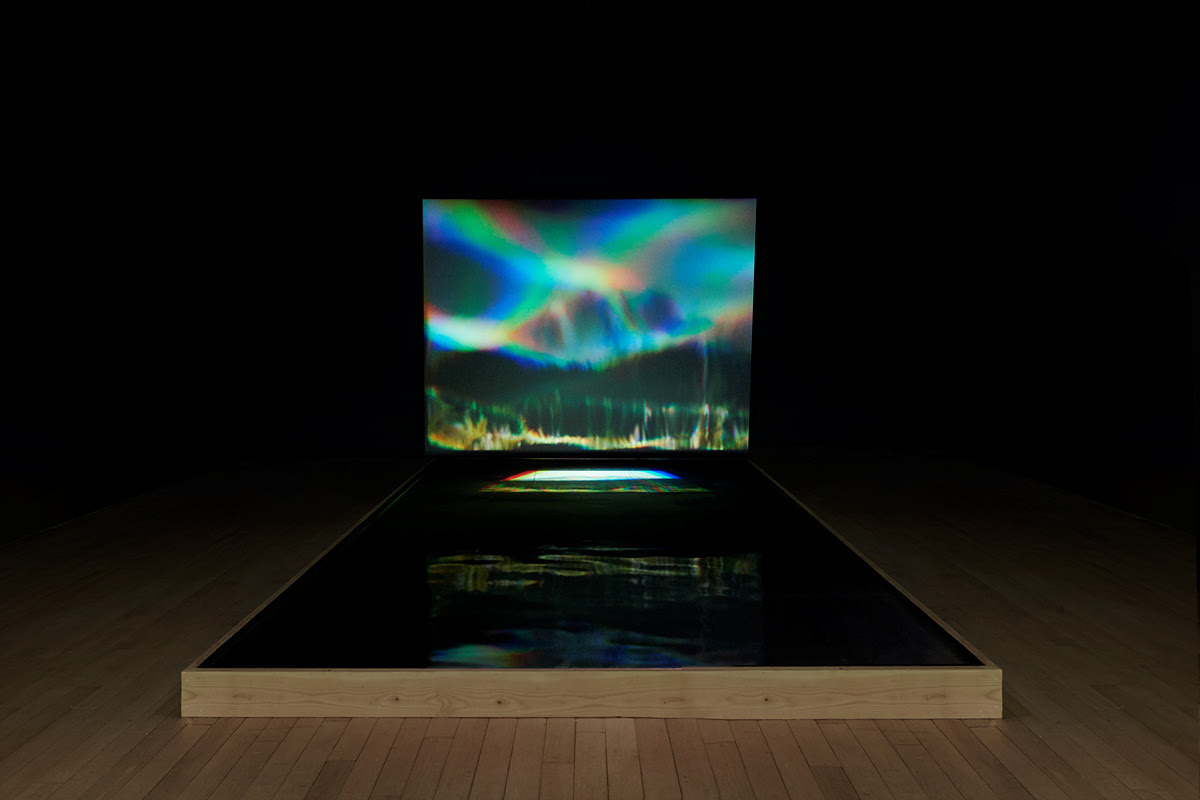

JW ART

GALLERY Exhibition view / ©JW ART GALLERY

JW ART

GALLERY Exhibition view / ©JW ART GALLERYJW ART GALLERY: Another Fraud Case

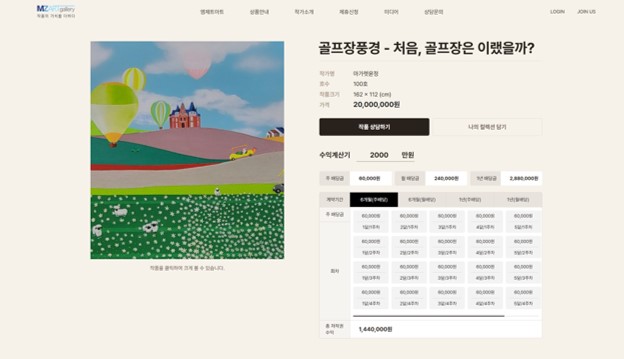

JW ART GALLERY, which

operated in a similar manner to GALLERY K, only dealt in low-value artworks and

photographs and promised to lease or copyright the customer's artwork and

distribute a fixed profit.

However, the police

investigation revealed that there was no actual rental or copyright revenue,

the works were left unattended in warehouses, and the company operated a

“revolving door” system to keep the money owed to customers until it finally

became insolvent. The company is said to have affected more than 1,000 people,

and its founder and members are currently in custody.

The

Korea Association of Professional Journalists (KAPJ) has selected Jiwoong Art

Gallery, an art management company, as the 2021 KAPJ's `Specialized Company for

Art Financial Stability' and awarded it with the association's certification

plaque. This is the second consecutive award after 2020. / Photo: Hankyung

The

Korea Association of Professional Journalists (KAPJ) has selected Jiwoong Art

Gallery, an art management company, as the 2021 KAPJ's `Specialized Company for

Art Financial Stability' and awarded it with the association's certification

plaque. This is the second consecutive award after 2020. / Photo: HankyungStructural limitations of the

Korean art market

The GALLERY K and JW ART

GALLERY cases highlight structural problems in the Korean art market. This,

coupled with past cases such as the forgery scandal, reaffirms the art market's

lack of credibility and transparency. In 2016, the Lee Ufan forgery case

sparked a legal battle over the authenticity of the work, which has yet to be

fully resolved.

The controversy over Chun

Kyungja's 〈Beautiful Woman〉 also exposed the

differences between artists and art institutions and highlighted the art

market's weak authenticity verification system. These problems have been

repeated in the art trade process due to lack of contracts, lack of physical

verification, and opaque practices. In addition, the lack of legal regulation

and institutional weaknesses contribute to the instability of the market as a

whole.

JW ART GALLERY Homepage Captured picture

Art Tech: Investing in NFTs

and Fractional share investing

As the art market has

expanded in recent years, the term art tech has come into vogue to refer to art

as an investment product.

NFTs and art sculpture

investments have also recently emerged as a new way to invest in the

contemporary art market, but they come with their own speculative risks.

NFTs, which emerged in 2022,

are touted as a guarantee of ownership of digital assets, but the market for

them has all but disappeared. The tens of billions and hundreds of billions of

works initially promised have all become trash.

Art sculpture investments

also have an attractive idea of decentralizing ownership of artworks, but there

is no guarantee of the actual value of the artwork, and investors are likely to

lose money due to difficulties in buying and selling. If you want to

participate in this type of investment, you should consult an expert or acquire

enough knowledge beforehand.

The Korean art market needs

fundamental reform

In order to fundamentally

solve the speculative problem of the Korean art market and the outdated

management structure, it is necessary to introduce a provenance system that

records the ownership history of artworks, clarifies the distribution channels,

and strengthens the authenticity verification system by creating a catalogue

raisonne that can systematically manage all works of an artist. It is also

necessary to secure transparency in the art market by requiring contracts and

physical verification during the transaction process and introducing an

authorized certification system.

In particular, public

education on new investment methods, such as NFTs and sculpture investment,

must be provided at the government level so that consumers can recognize the

risks and make rational decisions.

Investing in art is more than

just wealth accumulation, it is an important process of sharing artistic value.

The GALLERY K and JW ART GALLERY scandals highlight the backwardness of the

Korean art market, and it is imperative that structural reforms and a

transparent transaction system be put in place before any more such incidents

occur.

References

Jay Jongho Kim graduated from the Department of Art Theory at Hongik University and earned his master's degree in Art Planning from the same university. From 1996 to 2006, he worked as a curator at Gallery Seomi, planning director at CAIS Gallery, head of the curatorial research team at Art Center Nabi, director at Gallery Hyundai, and curator at Gana New York. From 2008 to 2017, he served as the executive director of Doosan Gallery Seoul & New York and Doosan Residency New York, introducing Korean contemporary artists to the local scene in New York. After returning to Korea in 2017, he worked as an art consultant, conducting art education, collection consulting, and various art projects. In 2021, he founded A Project Company and is currently running the platforms K-ARTNOW.COM and K-ARTIST.COM, which aim to promote Korean contemporary art on the global stage.