The impact of NFTs was so strong this year that the 2021 edition of ArtReview’s annual Power 100 has named ERC-721, the technical term for an NFT, as the most influential entity in the contemporary art world.

A paragraph in an ArtReview article written by Tina Rivers Ryan summarizes well the non-fungible token (NFT) art scene over the past year:

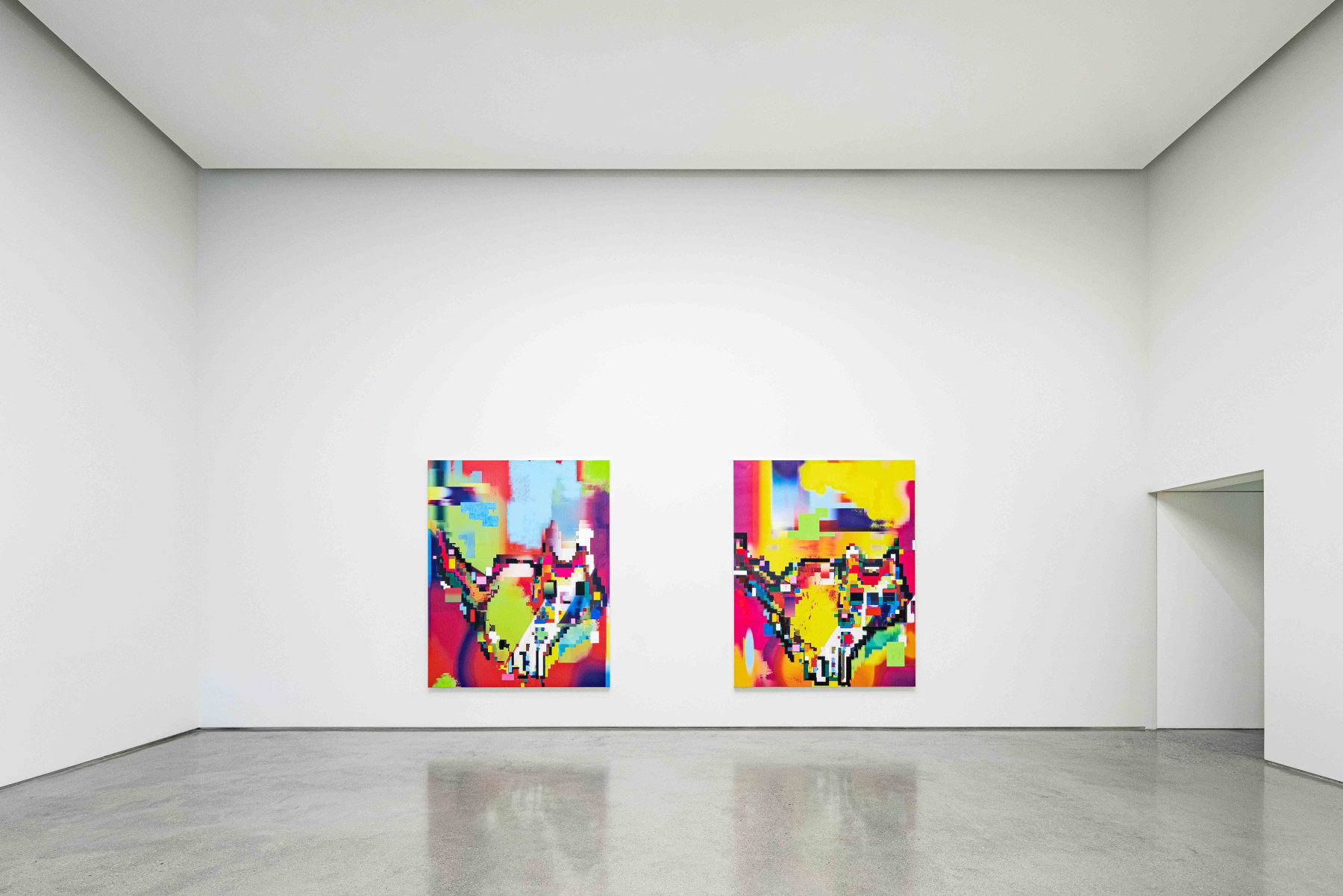

“Auction houses embraced NFT-native artists like Beeple, Pak, and Mad Dog Jones; galleries like König and Pace launched NFT sales portals; and blue-chip artists created NFT projects, most prominently Damien Hirst and Tom Sachs. Museums such as the Hermitage and the Uffizi minted works from their collections, while the UCCA Lab in Beijing and the Francisco Carolinum Museum in Linz offered surveys of this nascent movement. The ICA Miami even acquired a CryptoPunk.”

Photo by Pawel Czerwinski on Unsplash.

Photo by Pawel Czerwinski on Unsplash.As per data analysis site DappRadar, total NFT transaction volumes reached an all-time high of $23 billion this year, while they estimated the volume in 2020 as $63 million.

According to the Hiscox Online Art Trade Report 2021, in partnership with ArtTactic, the trading volume of NFT art and collectibles reached about $3.5 billion in the first three quarters of this year.

Photo by Arno Senoner on Unsplash.

Photo by Arno Senoner on Unsplash.NFT sales dropped by 69% in September 2021 showing signs of volatility, but the Hiscox report mentioned that generative art, in other words, NFT art projects that are computer-generated have recently been pulling the market back up again.

The report explained that the initial NFT art market boom was driven by single digital works, such as still images, GIFs, animations, and images of physical works created by single artists such as NFT-native Beeple and Pak or street artist Banksy.

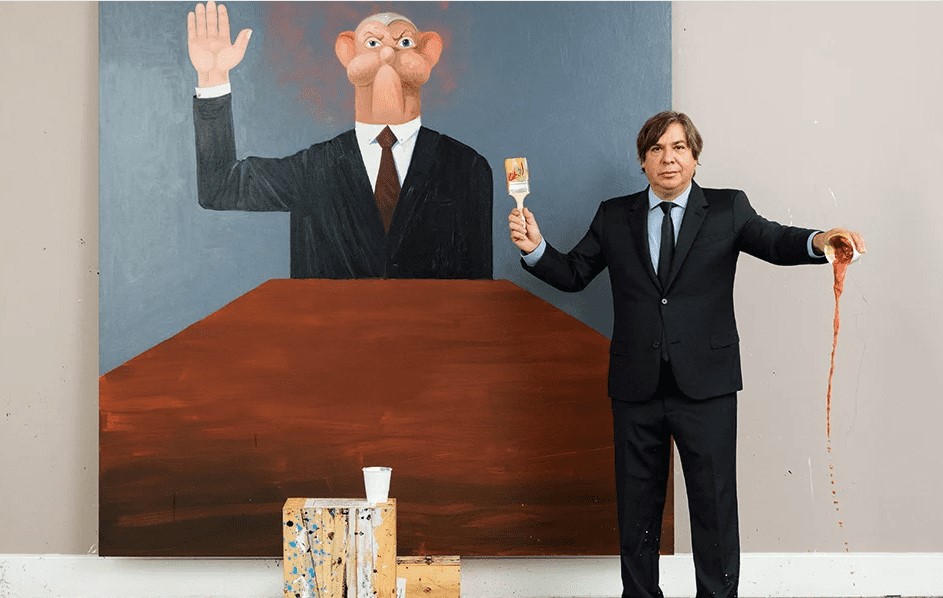

Some of the good examples are Beeple’s NFT work, Everydays – The First 5000 Days, which was sold for $69 million through Christie’s in March, and Banksy’s Morons, the original screenprint that was burnt to be resold as an NFT for about $380,000 in March.

Photo by Marius Masalar on Unsplash.

The trend has changed in recent months. The market has benefited from mass-participation crypto collections such as CryptoPunks and Bored Ape Yacht Club (BAYC). Each project includes a large number of unique digital artworks that approach community engagement.

The Hiscox report gives examples of what BAYC entails. BAYC consists of 10,000 original monkey images generated algorithmically. You become a member of the club by purchasing one of the apes and can then participate in its various advantages and get access to the evolution of the BAYC NFT collections, such as Mutant Ape Yacht Club (MAYC) and Bored Ape Kennel Club (BAKC).

According to DappRadar, CryptoPunks by Larva Labs, a collection of 10,000 unique, randomly created characters, is the second-largest traded collection ever, having generated more than $2.28 billion as of the report’s date of publication.

BAYC by Yuga Labs is also considered as one of the most influential NFT art projects; it has generated over $619 million in sales volume as of October according to CryptoSlam.

Photo by Jon Tyson on Unsplash.

NFTs work as proof of a digital file’s authenticity, ownership, and provenance, but recent purchases by new generations of collectors and investors are driven by being able to be part of the community around the project.

Although the NFT market has shown a significant drop, many including Hiscox and DappRadar see the recent NFT boom in the art market as a new growth phase rather than a temporary phenomenon.